What is FinTech? What services do FinTech companies provide?

Do you remember those times when we used to talk that there would be flying cars as technology has advanced a lot? Well, that time of flying cars hasn’t come yet but technology has advanced for sure. We have achieved technological development in other fields like talking robots and the possibility to live on the Moon. And finance, which was much needed.

In fact, technology in the field of finance has advanced so much that it has amalgamated with finance and these two have become one (word). Confusing? Well, let’s clear out the confusion of what I mean by finance and technology has become one.

What exactly is FinTech?

FinTech is a made-up word, which is a combination of two words- Financial Technology. So, now FinTech has become an industry wherein companies and start-ups use technological advancement to deliver financial services.

Simply putting, financial services are delivered using technology like the internet, smartphones, or laptops. The story of FinTech is completely different in western countries than in India. In India, some Fintech companies work differently than the ones in western countries like the UK and the USA, but some functions exactly like the ones there.

How do FinTech companies in India work?

A vast majority of the Indian population is still oblivious to the existence of the technological advancement India has achieved. A lot of people do not know how to operate smartphones or laptops and make the best use of the internet. So, the work related to FinTech in India follows a simple rule- “Provide financial services through technology to people who are not able to use the services themselves.”

FinTech companies in India, strategically, reach the areas which do not have banks, bank branches, and ATMs. These areas are called unbanked and underbanked areas in the language of FinTech. These areas come under the rural region at large but can also be found in the urban region. In a nutshell, the FinTech companies in India deliver Financial services through technology to the people who live in underbanked and unbanked areas and do not know how to use smartphones or laptops.

The limit or reach of the services of a FinTech company is not restricted to rural areas only. However, the success rate in rural areas is relatively high. In the beginning, the concept of FinTech services revolved around the empowerment of rural people and rural areas, but over the years, the scope of FinTech and FinTech services has expanded.

So, do FinTech companies go from area to area to provide these services themselves? Well, obviously not! So, how do they do that? FinTech companies use a distinct working model known as the “Retailer Model/Agent Model”. Let’s take a quick look at what this working model is.

What is a Retailer Model/Agent Model?

The number of unbanked and underbanked areas in India is more than anticipated. One area needs more than one person to provide FinTech services. Hence, FinTech companies enable more than one person to provide services to the people in their areas.

Let’s take the example of the Agent Model of BANKIT, which is a FinTech company based in Noida-

- BANKIT provides employment opportunities to the local shop owners of an area, usually covered under the category of unbanked and underbanked areas but not limited to them only.

- These local shop owners become “Agents” of BANKIT and start working with BANKIT to provide services to the people in the areas.

- BANKIT works for people indirectly by working with people directly. It reduces the level of unemployment and increases the level of digital financial accessibility.

Now the question that arises here is- “Is there a list of services that a FinTech company provides?”. Well, there is a list of services that a FinTech company provides. So, let’s take a deeper look into all the services that are provided by a FinTech company.

What are the services that FinTech companies provide?

The services provided by FinTech companies are divided into two parts. One part consists of the services offered for the convenience of the customers and the second part consists of the services offered for the convenience of the service providers such as the retailers, shop owners, and merchants.

Let’s discuss both parts in detail.

Services to the Customers

- AePS (Aadhaar-enabled Payment System)

Aadhaar-enabled Payment System is one of three main services of FinTech companies. This service has been introduced especially for the people residing in rural areas. An Aadhaar-enabled Payment System is used to withdraw cash from people’s bank accounts. It acts like a debit card for people who owns a bank account but do not how to operate a debit card. So, the Retailers/Agents of a FinTech company help people in their area with cash withdrawals from their bank accounts using their bank linked Aadhaar number.

- MiniATM

With the advancement of technology and the development of the world in general, as the size of the banks has decreased to the level where they have become so tiny that they can now fit into people’s phones, the size of ATMs has also decreased. MiniATM is the second main service provided by FinTech companies. It has been introduced to help people in unbanked and underbanked areas to withdraw money from their bank accounts using their debit cards in absence of bank branches and ATMs.

- DMT (Domestic Money Transfer)

Domestic Money Transfer is the third main service that is provided by FinTech companies. This service helps unbanked and underbanked people transfer money to any bank account in India. The Retailers/Agents of FinTech companies help people in their areas to transfer money without visiting a bank.

- Loan

FinTech companies have made the credit process easier for everyone. Instead of going for the lengthy and complex loan process of banks, people reach out to FinTech companies to get loans.

- Prepaid Recharges

Prepaid recharges for the services like Phone, DTH, Data, FASTag, and OTT Platforms have been made easier by FinTech companies for people living both in rural and urban areas.

- Utility Bill Payments

FinTech companies also provide the service of Utility Bill Payments for different utility services like Electricity, Water, Gas, Mobile Postpaid, DTH, Landline Postpaid, and Broadband Postpaid.

- Travel & Stay

The service of Travel & Stay Bookings is also available for people residing in rural and urban areas by FinTech companies. The Retailers/Agents of FinTech companies can book flight tickets, and bus tickets and make hotel bookings. FinTech companies also provide IRCTC ID. With the use of an IRCTC ID, Retailers/Agents of FinTech companies can book train tickets for their customers.

- Cash Collection Service

The Cash Collection Service of FinTech companies is concerned with helping people with a one-stop payment solution for Loan EMIs of different billers. Retailers/Agents of FinTech companies help customers in their areas to pay EMIs of their loans if they have no resources with them to make the payment. Cash collection service also helps the food delivery agents like food delivery agents of Zomato and Swiggy to collect cash from customers and deposit it with Retailers/Agents of FinTech companies, who would transfer the money to Zomato and Swiggy.

- LIC Premium and Credit Card Bill Payment

With thousands of people using credit cards and having an insurance policy with LIC, the effortless payment of both becomes important. Therefore, some FinTech companies also provide the service of making LIC Premium and Credit Card Bill Payments.

- Insurance

Amidst making decisions about which insurance to use, people end up having none. Hence, to ease up the process of owning insurance conveniently, FinTech companies also provide Insurance services to people.

Services to the Service Providers

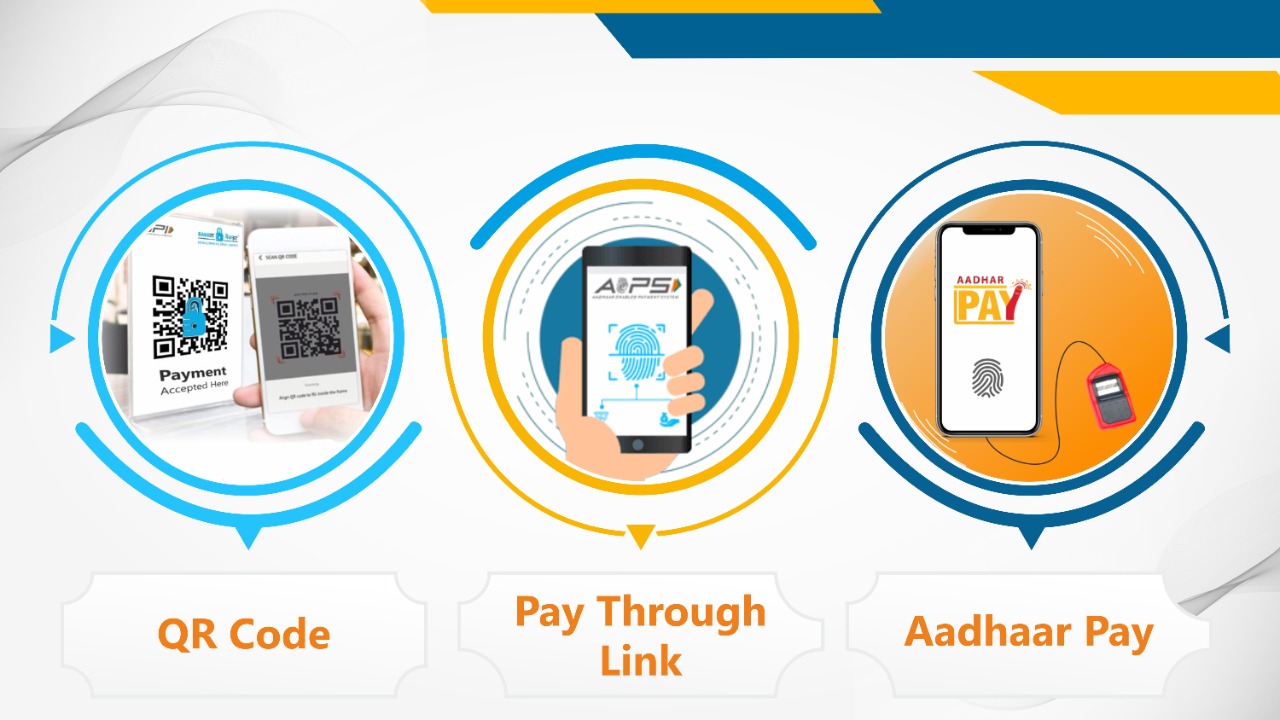

The convenience of the service providers lies in the ease of having comfortable payment acceptance modes. So, FinTech companies provide three modes for accepting payments from customers. So, what are we waiting for? Let’s dive in!

- QR Code

Quick Response or QR Code is the best and the most convenient way to accept payment from customers. FinTech companies have made accepting payments easier for retailers, shop owners, and merchants. All one has to do is show their unique QR Code to the customers and after scanning the QR Code, UPI Apps catch the amount to be paid and start the payment process.

- Pay Through Link

Pay Through Link is another way to accept payments. In this method, a service provider sends a link to the customers. After clicking on the link, the customer reaches the payment page, on which, he finds all the details of the payment. The customer only fills in the details and makes the payment easily.

- Aadhaar Pay

In this payment method, a service provider can accept payments from the customers using the customers’ Aadhaar and a biometric device. This new payment method introduced just a few years ago has proven helpful for service providers.

With digital banking, financial, and payment services, FinTech companies are not only increasing the accessibility of technological advancement to the remotest areas of India but are also increasing the level of employment. The number of FinTech companies is continuously increasing since 2016 and FinTech companies are said to be the future. So, it's high time that you too get associated with one of the FinTech companies like, let's say, BANKIT!

BANKIT is a Noida-based FinTech company that provides digital banking, financial, and payment services to the unbanked, underbanked, and migrant population of India through its wide Agent network.