What is AePS Cash Withdrawal? How Does AePS Work?

The world is going digital in terms of the money transactions we make. However, no matter how digitalization we bring, the day when cash will lose its supremacy is way too galaxies away. Money in its paper form will always be needed.

Now, the biggest issue that arises here is the availability of sources that can avail a person of cash. There are banks and then there are ATMs. Either of these two sources is used when people think of obtaining cash.

In Indian urban areas, these two sources are found, if not in abundance, then surely in enough quantity that people don’t have to struggle when they need cash. The worst sufferers are the people living in rural, unbanked, and underbanked areas. People living in these three areas don’t have enough banks and ATMs nearby from where they can withdraw cash for themselves.

What is AePS?

AePS is elaborated as Aadhaar Enabled Payment System. AePS was introduced to empower a person to use his/her bank-linked Aadhaar to enjoy banking services. It is a National Payments Corporation of India-supported payment method that has been proving fruitful in helping people use banking services without visiting a bank or ATM.

AePS is used to help people withdraw cash from their bank accounts using their Aadhaar. Since in AePS, Aadhaar works as a debit card, it is also known as Aadhaar ATM.

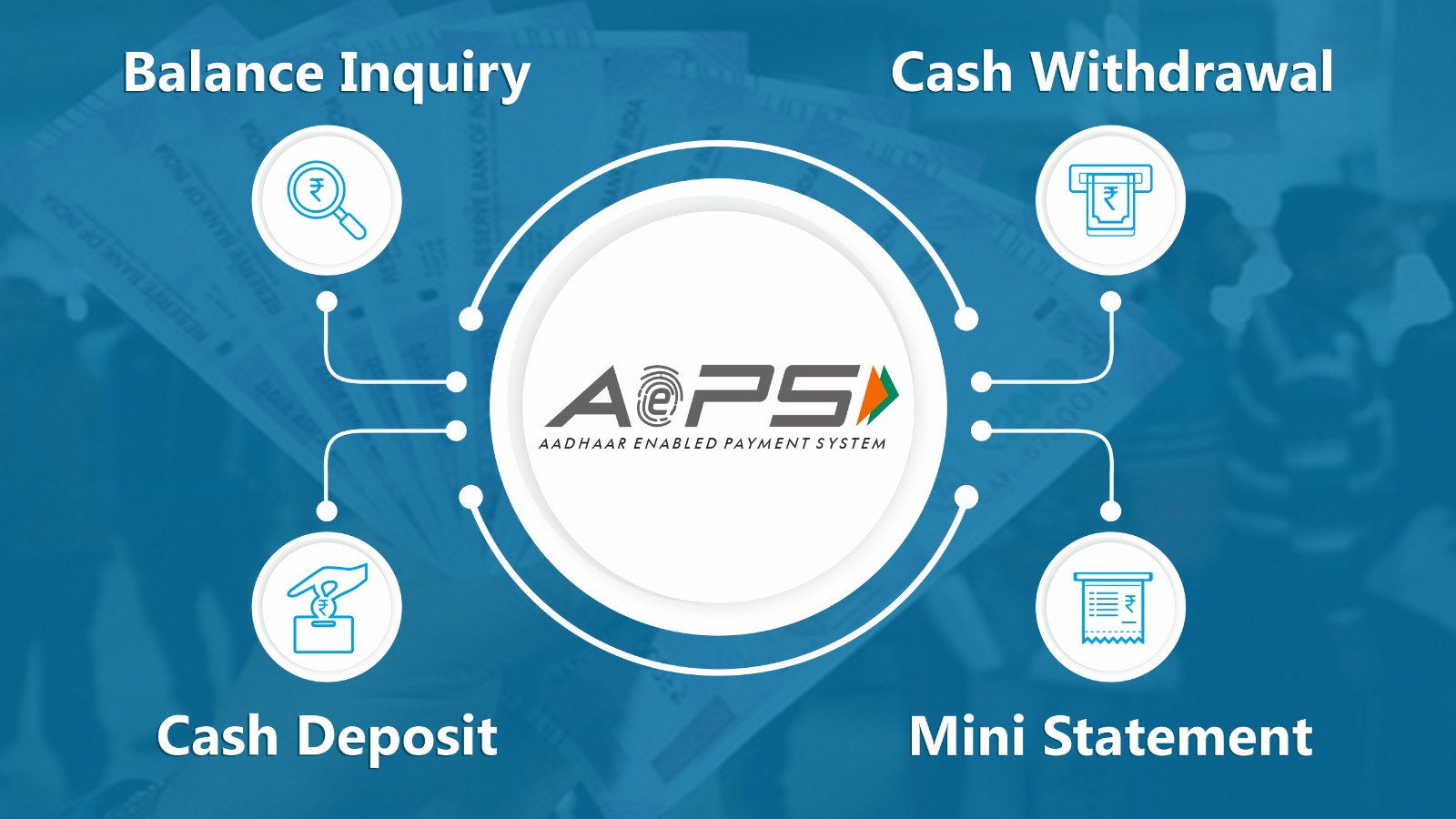

What are the services provided by AePS?

Aadhaar enabled Payment System offers various banking services to people living in rural, unbanked, and underbanked areas like cash withdrawal, cash deposit, balance enquiry, and mini statement. AePS provides a convenient and secure way for people to access basic banking services without the need for a traditional bank account, debit card, or ATM.

AePS (Aadhaar Enabled Payment System) or Aadhaar ATM provides the following three services:

- Cash Withdrawal: This service enables customers to withdraw cash from their Aadhaar-linked bank accounts. The customer can visit any AePS-enabled banking point and perform a cash withdrawal transaction using their Aadhaar number and biometrics (fingerprint or iris scan).

- Balance Inquiry and Mini Statement: This service allows customers to check the balance of their Aadhaar-linked accounts or obtain a Mini Statement. The customer can simply use their Aadhaar number and biometrics (fingerprint or iris scan) to access their account information at any AePS-enabled banking point.

- Cash Deposit: This service allows customers to deposit cash into their Aadhaar-linked bank accounts. The customer can visit any AePS-enabled banking point and perform a cash deposit transaction using their Aadhaar number and biometrics. The funds will be credited to their Aadhaar-linked bank account instantly.

Read here to know more about other FinTech services.

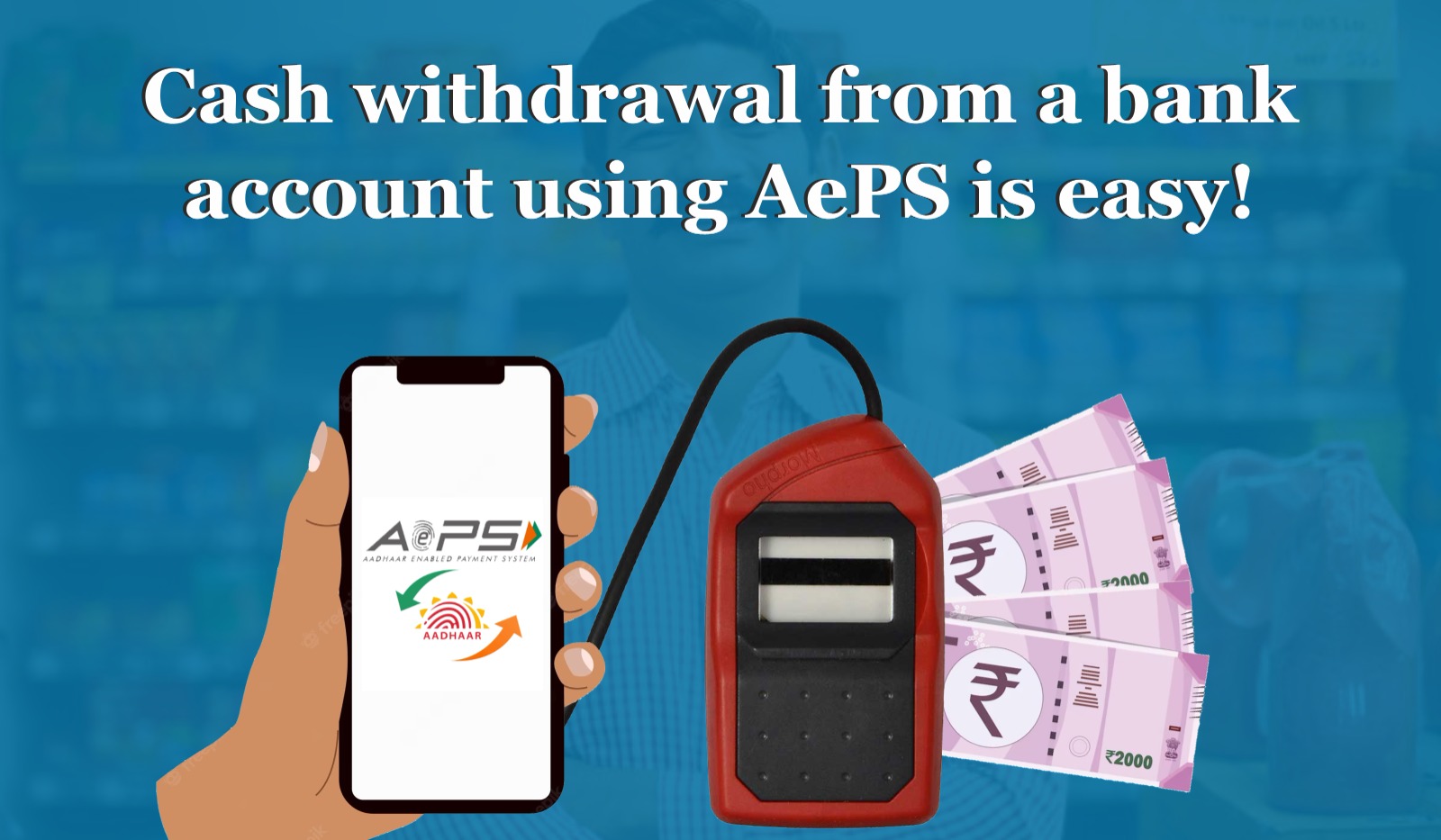

How does AePS work?

AePS uses the Aadhaar number of the user to authenticate their identity and to provide access to their bank account. To use AePS, a user needs to have their Aadhaar number linked to their bank account. Once the Aadhaar number is linked to the bank account, the user can perform various banking transactions through AePS, including cash withdrawal, balance enquiry, mini statement, and cash deposit.

A person with a bank-linked Aadhaar visits the nearby AePS Service Provider and selects the banking service they wish to avail of. The AePS Service Provider then uses the Aadhaar number and name of the bank of the customer to start the process, and once the number is entered, the user needs to place their finger on the fingerprint scanner to authenticate their identity. The AePS Service Provider then connects to the user's bank account and performs the requested transaction.

In the end, a receipt of the transaction made is printed and handed over to the customer as a record of the transaction, and an AePS cash withdrawal message is received by the recipient.

AePS business is the fastest growing business in India. If you are looking forward to starting an AePS business from your shop or place of comfort, through BANKIT you can become a source of providing solutions for banking needs to people who need them.