Myths vs. Facts: Becoming a Neighborhood Banker with BANKIT

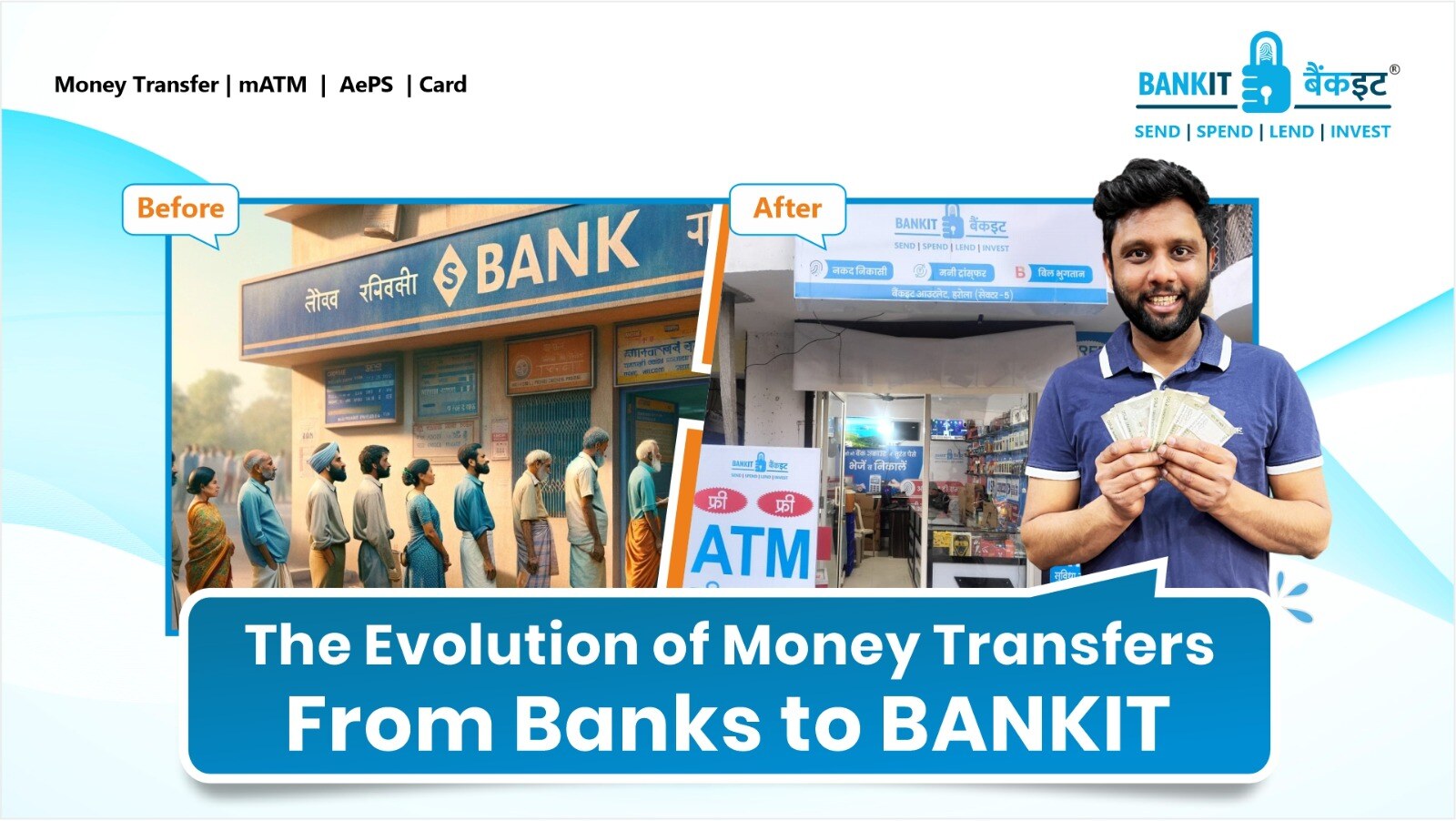

In the ever-evolving world of finance, the role of a local banker is becoming increasingly vital, especially in rural and semi-rural areas. However, many people hold onto misconceptions that can deter them from seizing this opportunity. At BANKIT, we believe that everyone should have access to financial services, and we’re here to help you understand what it truly takes to become a banker in your neighborhood. Let’s explore the common myths and the realities behind becoming a BANKIT agent.

When discussing the prospect of becoming a banker in your community, various myths often come along, creating unnecessary barriers. Many individuals believe that this role requires extensive education, advanced technical skills, or significant investments. However, BANKIT is committed to making this opportunity accessible to all, regardless of their background. This blog aims to debunk these myths and illustrate how you can empower yourself and your community through BANKIT.

Myth: You Need a High Level of Education or Special Degrees to Succeed

Fact: One of the most prevalent myths is that you must have advanced education or specialized Financial degrees to become a banker. The truth is that a basic understanding of financial concepts can be helpful, it is not a prerequisite. Anyone from any educational background can apply to become a banker at BANKIT. What’s more important is your willingness to earn connections and communications with your community. The more you connect with your customers and hear their needs and requirements the more you will earn.

Our comprehensive training program is designed to equip you with the knowledge and skills necessary to succeed as a BANKIT agent. From understanding the services you can offer to effective customer engagement strategies to 24*7 customer support, we provide all the resources you need.

Myth: Advanced Technical Knowledge is Required

Fact: Many potential agents hesitate to apply because they believe they need advanced technical skills to navigate banking platforms. However, this is a misconception! At BANKIT, our platform is very user-friendly and easy to use, you don’t need to be a tech expert to operate our App and Portals.

We understand that technology can be intimidating for some, which is why we provide hands-on training to ensure you feel comfortable with the tools you'll be using. Our portals are user-friendly, enabling you to serve your customers with ease. Our services are easy to use even if you just have basic digital skills, so you can concentrate on developing relationships with your customers rather than getting stuck down by confusing technology.

Myth: It Won't Generate a Great Income

Fact: There is a common belief that becoming a local banker won’t provide significant financial income. Because agents earn through each transaction they complete, they can tailor their income based on how many services they provide such as bill payments, mobile recharges, cash withdrawals, and more. Your earnings will largely depend on your engagement with the community and the services you provide. As a BANKIT agent, your earnings increase with every transaction you complete. Many agents find that they can generate consistent income by setting their own hours and providing additional services like booking travel tickets, hotel bookings, and many others.

Myth: The Process Involves Complex Procedures and Hidden Costs

Fact: Many believe that registering as a BANKIT agent involves a lengthy and complicated process filled with hidden costs. In reality, the registration process is simple and transparent. The main requirements to become a BANKIT agent are basic reading and smartphone skills. Educational requirements are minimal, with more focus placed on practical, everyday skills. Often, people who know their community well succeed in this role, as they’re able to build strong relationships with customers and explain services clearly.

At BANKIT, we value clarity and support. There are no hidden fees or complicated paperwork. We aim to make your entry into this rewarding role as smooth as possible.

To become a BANKIT agent you just need to follow these simple steps & you earn attractive commissions on each service transaction to the customers.

- Visit the registration page via BANKIT's website or you can download the BANKIT agent app

- Choose your plan as per your requirement starting from Rs. 350 only.

- Complete your KYC & physical verification process after payment.

- Once your registration is complete, you'll receive your unique agent ID, which you can use to access a range of banking services (a few services like AePS, etc. will be activated after a successful physical verification process).

- Enjoy the convenience of hassle-free banking and financial transactions anytime, anywhere.

Myth: Digital Banking Isn't Safe or Trusted

Fact: The belief that digital banking is unsafe and untrustworthy is another myth that persists. In reality, BANKIT takes customer safety very seriously. We make sure to implement security measures like biometric authentication, one-time passwords (OTPs), and KYC (Know Your Customer) requirements to make digital transactions extremely safe. BANKIT has strong security protocols and offers training to agents to help ensure that transactions are secure and customers’ information is protected.

Myth: Starting Requires a Large Investment

Fact: Some think that becoming a BANKIT agent requires significant financial investment in equipment, certifications, or other expenses. This is simply not true with BANKIT. The initial investment to become a BANKIT agent is minimal—typically just a smartphone with internet access. BANKIT’s registration fees and setup costs are structured to be affordable, making it easy for almost anyone to get started. By keeping the cost of entry low, BANKIT makes this opportunity accessible to a wide range of people, from students and stay-at-home parents to small business owners. With just a smartphone and your time, you can quickly start earning as a BANKIT agent without needing expensive equipment or large investments.

Myth: Customers Won't Trust Local Bankers for Cash Transactions

Fact: There’s a misconception that customers in rural areas may not trust local bankers for cash transactions. On the contrary, many customers prefer to deal with local agents who understand their community and can provide personalized service. Such agents often gain strong trust by being from the same community and offering friendly, familiar service. Customers feel comfortable with BANKIT agents because they are approachable and accessible right in the neighborhood and also communicate in their local language, unlike the formal environment of banks.

BANKIT agents serve as the local face of digital banking, creating personal relationships with their customers. By answering questions and providing reliable, accessible service, agents can easily establish themselves as trusted community bankers who offer a more personal alternative to traditional banking.

Empower Your Community and Yourself

Becoming a banker in your neighborhood with BANKIT is not just a career; it’s an opportunity to empower yourself and those around you. By dispelling these myths, we hope to inspire you to take action and join us in enhancing financial access for underserved communities.

As a BANKIT agent, you will play an integral role in transforming how your community interacts with banking services. With our training, support, and your commitment, you can establish yourself as a trusted banker, making a significant impact in the lives of your neighbors.